The financial health of your law firm or any business is ultimately dependent on three simple concepts:

- Getting the work (selling your product – yes, you are a salesperson disguised as a lawyer))

- Doing the work (building the product)

- Getting paid for the work (collecting the money)

You need to keep a steady flow in all three components and monitor your results to make sure your business is financially healthy. Envision a pipeline with a steady flow of water. At any point in the pipe when the source of the water slows down, a clog occurs in the pipe or even a leak, the output will be affected. All 3 have to work together in order to keep a steady flow.

Keeping an eye on the flow is essential to making sure you are maintaining a profitable business. But in addition to keeping an eye on things, the ability to measure the flow is an important metric for profitability. For law firms, one key metric is something referred to as realization and there are two types of realization rates that come into play in the financial management of a law firm: Billing Realization and Collection Realization. Both of these metrics affect the amount of water that is getting through your pipeline.

Gwynne Monahan recently published an article for Clio that discussed the concept of Big Data and how the accessibility and collection of data has evolved with the growth of cloud based technology. The truth of the matter is that five years ago a solo or small firm attorney simply did not have the products that are available today. So the concept of producing realization and profitability reports was simply out of the question due to the lack of data collected to compile meaningful reports and the amount of time it would take to sift through the data if it was being collected.

Collection Realization Rates

I am going to start with the end in mind and talk about collection realization rates and how to mine this data in Clio to track and measure your firm’s collection realization rates, revenue and profitability. Your ability to collect what you billed is not only a financial indicator but quite often it is a measurement of your client’s satisfaction with the work product. So at the heart of it, the collection realization rate and the rate of payment is a direct correlation to your client’s level of satisfaction and your profitability. Happy clients pay their bills.

A side note: you can increase your revenue but if you are spending at the same rate you are increasing, the increase in profitability will not be there. Focus on the overall health of your firm by increasing realization rates and monitoring expenses.

The collection realization rate is the simplest of realization rates to calculate. Just what is it and how do you use Clio to calculate and track this rate?

Your collection realization rate is the percentage of your billed fees which are actually collected.

Billed Fees/Collected Fees = Collection Realization

Once a bill is sent out using Clio’s new billing workflow, there are three possible outcomes:

1) The bills gets paid in full in one payment or over time (100% collection realization)

2) The bill gets partially paid with eventually a write off of the unpaid balance (Less than 100% collection realization)

3) The bill never gets paid and it is a total write off (0% collection realization rate)

Using Clio to Get Your Data

In Clio, the data to calculate your collection realization rate is in a report called Revenue Report. With all of this great data at your fingertips, you can calculate the following collection realization reports for different periods of time – monthly, quarterly, yearly. My suggestion is to create these reports monthly with YTD data by selecting the date range for current year. A monthly snapshot will exclude payments outside of your date range and thus will not be a true picture of collection activity.

1) Collection realization for the whole firm

2) Collection realization by responsible attorney

3) Collection realization by matter

4) Collection realization by client

5) Collection realization by billing type (flat fee vs. hourly)

6) Collection realization by practice area

7) Track your trends in each area with a chart

The key to getting all of this data is sending the report to a CSV file. The CSV file includes more data than is on the report and you can sort the data to produce one of the above reports.

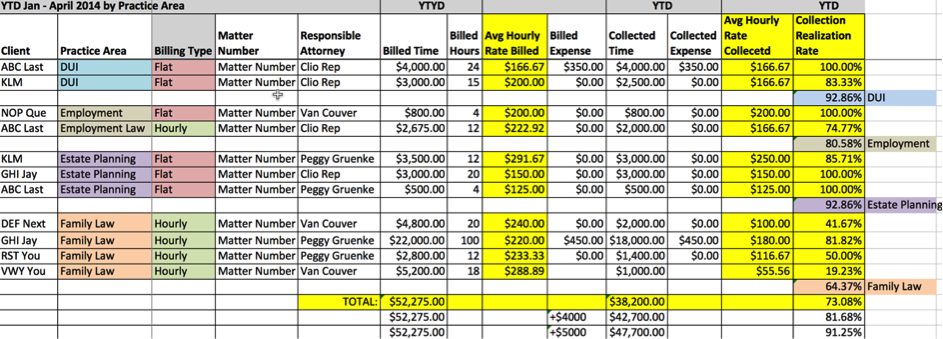

Once the data is exported, convert the file to an Excel format so you can work some magic with formulas and charts. The key columns of data you want for the purpose of collection realization are below. The columns in Yellow are added with formulas embedded. The formulas are using the data Clio provided in the report. Billing Type has been added. It is not currently in the Revenue Report but easy enough to add if this metric is important to you.

The below spreadsheet shows collection realization by matter and practice areas:

The power of data right at your fingertips – I love it! Give me an Excel spreadsheet and I can sort, sum, calculate, evaluate and make decisions. You can’t argue with real numbers. The above spreadsheet shows the collection realization rate by individual matter and by practice area. Also note that Clio is separating Time value from Expenses. More good data for evaluating the firm’s ability to recover firm paid client costs. I have chosen to calculate collection realization only on Time value.

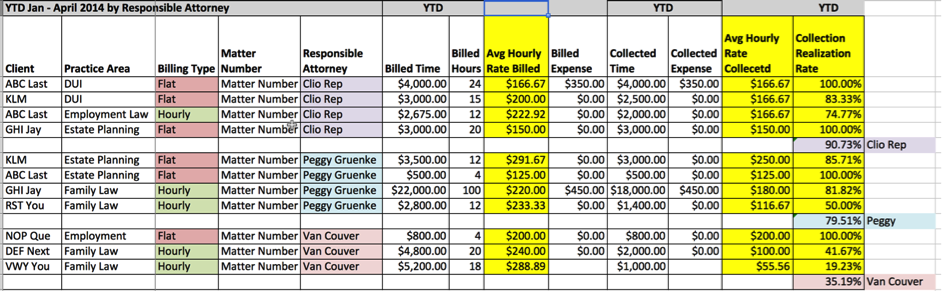

This spreadsheet shows the collection realization rate by responsible attorney. This may highlight a problem area you did not know existed. Mr. Van Couver probably needs to improve his client selection, get more money up front or do a better job of keeping his clients happy.

What is a good collection realization rate?

The goal for your firm wide collection realization should be 90% or higher. Now that you have this data, you can create some what-if scenarios to visually see how focusing on improving your collection realization directly affects your revenue and profitability. You can also see the importance of digging deeper into the data and not focusing just on the firm wide number. By looking at the data by practice area or responsible attorney, you can determine where to focus your efforts for improving the rate. In the above example, at the bottom of the spreadsheet you can see the affect of increasing your collection realization rate and it’s affect on revenue.

The one measurement I found rather interesting is the collection realization rate for hourly vs. flat fee work. For the data I collected, I know that a large percent of the flat fees are collected up front. This is not a measurement of flat fee profitably – this topic is for another article. For the hourly work, this particular firm is not diligent about getting retainers up front. The numbers speak for themselves.

So What is the Data Telling You?

If you think of it in terms of dollars and cents, in this example the firm’s overall collection realization rate is 73%. You are collecting 73 cents out of every dollar you bill. So 37% of all billed revenue is getting written off, after the bill goes out the door. These write-offs could be a result of any of the below or a combination:

- Bills not getting out the door on a regular schedule

- Bills going out incorrectly

- Bad collection practices

- Dissatisfied clients because bills were late, incorrect or poor client management

With Clio, you have the tools to help manage the first three scenarios using the new billing workflow and using the accounts receivable report and statements of accounts. The most successful billing and collection procedures are a result of delegating one person for getting the bills out and the money in the door. This person can set up workflows and processes they can manage and stay on top of. You can use Clio to help manage your collection process by keeping notes, assigning tasks and using the new task lists for follow-up and sending regular reminders during the month.

A well-designed and implemented collection procedure will help improve your collection realization rate and result in increased revenue. I have also found these tasks are not the best use of a lawyer’s time and resources. Billing and collections are two tasks that can be easily outsourced, especially if you are using cloud-based platforms.

Now that You Know You Number, How Do You Make it Better

After creating your collection realization worksheet and monitoring it monthly, if you are below the 90% minimum level, here are some ways you can improve this rate:

- Create a firm wide rule to request and collect an adequate advance fee deposit for every case. Now that you have data available to see the positive affect on such a policy, you can reward the attorneys who are following this rule.

- Get better at case/client selection and listen to your gut

- Really look at what practice areas are most profitable and which ones are having a negative impact on collection realization

- Make sure your written fee agreement details your expectations of payment, as well as what will happen if payment isn’t received timely

- Bill timely and prepare bills that are easy to read

- Develop, follow and delegate a collections policy that goes into effect immediately when an account first becomes past-due

So if you are not growing your practice, the answer may not be to do more marketing. The answer may lie within this data. Realizing the affect your collection realization rates have on your bottom line should be motivation enough to start monitoring and tracking these numbers today!

Share your thoughts